The weekly agenda_05.06.2020

The four trends discussed — macroeconomic and regulatory developments, technology, and customer behaviour — will evolve in different ways depending on region. To survive, thrive and maintain competitiveness, institutions should respond to playing in advance. Policymakers should help the industry become more productive and achieve better work opportunities and infrastructure outcomes for citizens and people stand to benefit from better infrastructures at a lower cost. The world of commodities over the past 15 years has been rocketed by a “supercycle” that at first sent prices for oil, gas, and metals soar, only for them to come crashing back down. Now, as resource companies and exporting countries are trying to shift their economic structure, they face a new disruptive era of technological innovation. Governments and regulators faced the adoption of robotics, artificial intelligence, Internet of Things technology, data security and cryptocurrency — along with macroeconomic trends and changing consumer behaviour. All players in the value chain will need to develop their strategies for dealing with their positions for new economic demand. Also, it is crucial to adjust an awareness and knowledge sufficiency to make a ban for the coming industry innovations. Instead of taking advantages, more common practice is to forbid as the threat that eliminates countries development throwback on decades. All will need to refine in enablers of agile guidelines of the regulatory framework. Undoubtedly, how large this opportunity ends up depends not only on the rate of technological adoption but also on the way resource producers and policy makers adapt to their new environment.

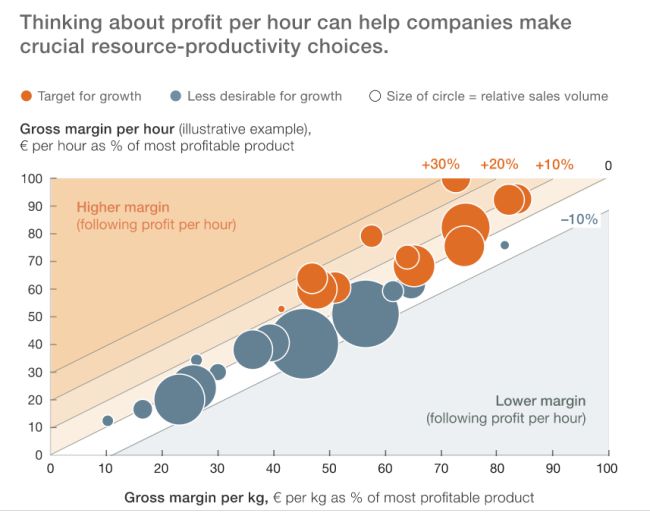

Over the past decade, 50 per cent of global FDI flow went to companies in Asia, enabling them to scale up. Today, the Asian company's revenue is evaluated by 43 per cent of the world's largest companies’ global revenue flow. However, the point is that scaled investment has not gained higher economic profit. Globally, returns have fallen because of an abundance of cheap capital. According to Mc. Kinsey research, economic profit fell from $726 billion in 2005–07 to $34 billion in 2015–17. Three main factors explain regional's declining economic profitability over this period. The most significant factor that affected 44 per cent of the decline, was a cyclical downturn in energy and materials. One-third of the drop can be attributed to the allocation of capital to value-destroying sectors, particularly in China. The remainder of the decline was because of the underperformance of companies in Asia relative to their global peers. To concern the future of FDI flow, as well as significant performance gap overcome, new McKinsey Global Institute report, "Beyond the supercycle" has exposure how technology is reshaping resources, focuses on these three trends and finds they have the potential to unlock around $900 billion to $1.6 trillion in savings throughout the global economy in 2035. That sort of comparison can help companies make crucial resource-productivity choices shown at the exhibit 3

Source: https://www.mckinsey.com

Well-advised Investors used to foresight in their investment activity and followed by ample opportunity to generate the outcome from the most prospective, leading companies. The expectations in Europe, related to Covid-19 crisis will accelerate the uptake of automation as well as an increased focus on climate change and supply chain risks. According to a survey, a vast majority (82%) agreed that "the adoption of technology that automates manual human processes" and new infrastructure demand will accelerate in the next three years. A detailed look at key sectors reveals significant opportunities for increasing performance.

Last weekend, we witnessed the SpaceX became the first private company to send its own shuttle with astronauts into space on its own reusable rocket with the final docking with the International Space Station. The main advantage of SpaceX was the ability to reuse the first stage, which significantly reduces the cost of launches. The main conclusion of this event is that the space industry can develop not only through government programs but also on a commercial basis. The industry used to be deprived of the attention of both investors and government agencies in recent years. However, the successful design and implementation of projects in the "SpaceX" has shown that it can be commercially viable. This example can encourage investors, especially with the expectation of the growth in the industry. The volume of the global space flight market, according to Allied Market Research estimates, amounted to $ 9.88 billion in 2019 and by 2027 it is projected to grow to $ 32.41 billion, which corresponds to average annual growth of 15.7%. The driver of market growth is the increase in the number of space launches.

There is a global transition to a cleaner future by strengthening their lead in renewable energy and electrification and by expanding into rapid-growth areas, such as liquefied natural gas. As Winston Churchill said, "Now this is ...the end of the beginning." It starts. A detailed look at five key sectors reveals signs of thriving such sectors. Real-estate companies will be managing diverse portfolios and using technology to achieve end-to-end process improvement. Banks are likely to continue growing as incomes rise, and the middle classes expands. Whereas the automotive industry within the mobility reduced, demand is under the hardest hit. However, the trends may vary by region, outcomes for mobility players will differ by location. Macrolevel weakness could spur people postpone discretionary purchases and increase their savings as they anticipate harder times ahead. According to recent McKinsey research, discretionary consumer spending may decline by 40 to 50 per cent. Construction is the biggest industry in the world, that is outside of crises. Time and cost overruns are the norm, and overall earnings before interest and taxes (EBIT) are only around 5 per cent despite the presence of significant risk in the industry. Such combination of sustainability requirements, cost pressure, skills scarcity, new materials, streamlined approaches, digitalization, and a new breed of the player looks set to transform the value chain. The shifts ahead include specialization, increased value-chain control, and more excellent customer-centricity and branding. The only way of consolidation and internationalization will create the scale needed to allow higher levels of investment in digitalization, R&D and equipment, and knowledge diffusion as well as human capital growth to provide these improvements through refining our education system.

Moglino SEZ as the part of joint supply chain system, provided by resource- monopolies as well as infrastructural dependence with the Pskov region has a range of technical approvement negotiations. Aiming at the sync of moving to the new economic timeframe, construction technologies refine increasingly. While out of date operations incompatible with an efficiency required. Our shifting to predictive maintenance, and using sophisticated data analysis to identify, extract, and manage resources. From the big picture, Moglino SEZ as the most influenced by deglobalization and micro-market strategy implementation, stand behind the new economic reality, getting recognized how things are done by the distinctive approach. We are is keeping up to the schedule of the large-scale works on engineering infrastructure development at the new land plot on 80 Ha, overcoming the challenges with all occurring technical questions.